| Starting April 5, 2014, several changes will be implemented to the U.S Census Bureau Foreign Trade Regulations (FTR). Some of these changes involve goods leaving the U.S. under an ATA Carnet. All exports leaving the United States, except temporary exports, have historically required Electronic Export Information (EEI) filing. However, the types of exemptions that exist today will be greatly curtailed effective April 5, 2014. These changes greatly affect ATA Carnet shipments, as they cover both U.S. issued ATA Carnets and foreign ATA Carnets used for temporary importation into the U.S.

Narrowing the temporary export exemption

Goods moving under the ATA Carnet are no longer automatically exempt from the EEI filling. To avoid any possible delays in your goods reaching their destination on time we are working with U.S. Census and U.S. CBP to fine-tune the acceptable equivalencies for the required data elements.

ATA Carnet exemptions

There are still some exemptions that ATA Carnet shipments can qualify for:

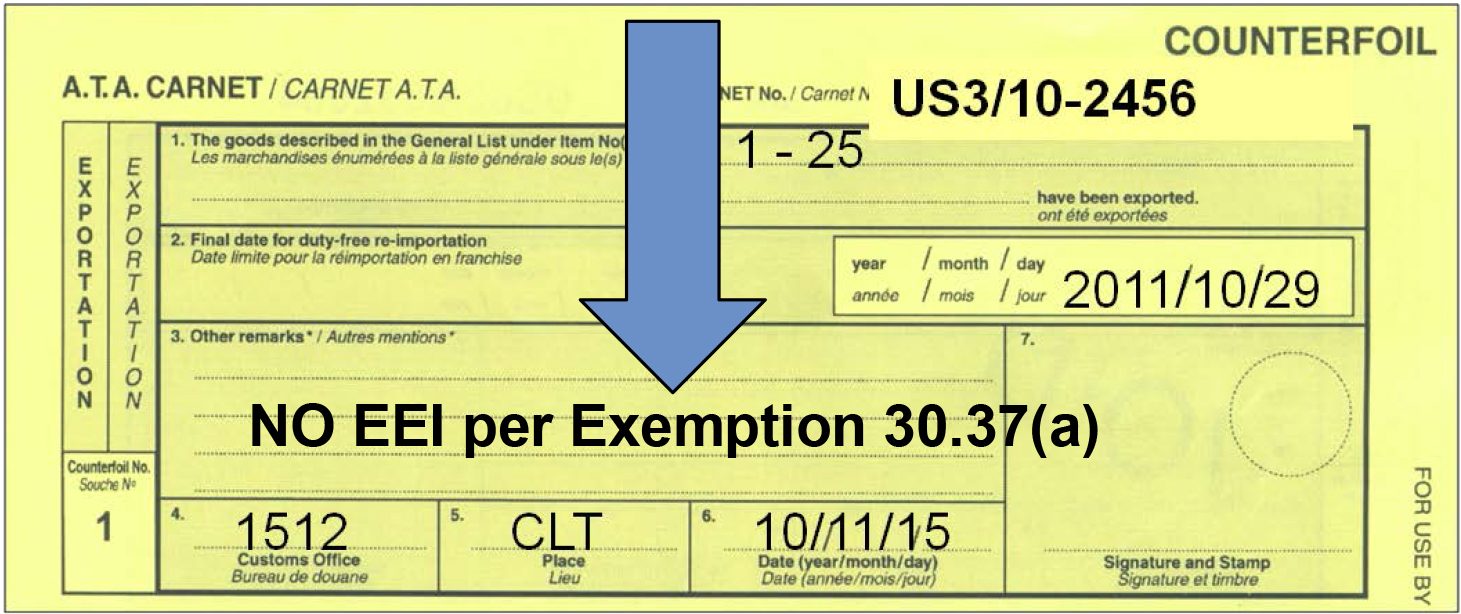

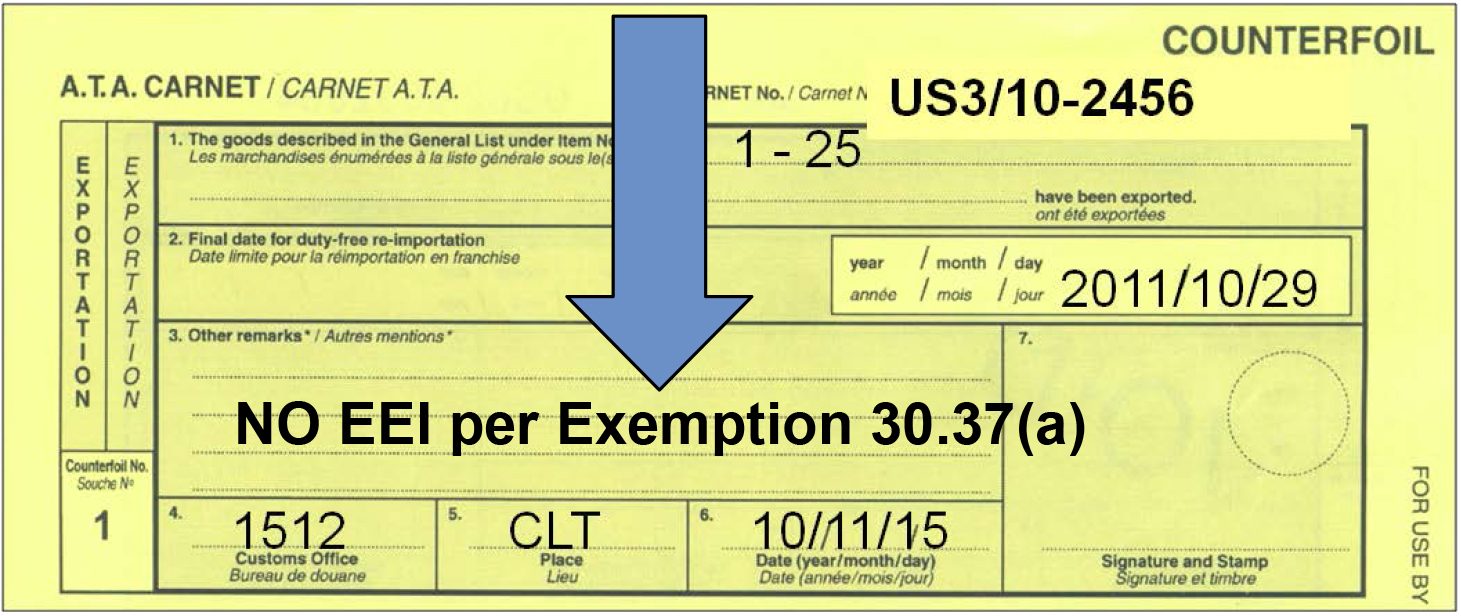

- Low Value Exemption: goods valued at or below $2,500 per individual Schedule B/HTSUS commodity classification code do not need to be reported (see 15 CFR 30.37(a)). If the General List on the ATA Carnet contains multiple Schedule B/HTSUS numbers, and no single item or the sum of total items per Schedule B/HTSUS is valued at more than $2,500, then the ATA Carnet shipment will be exempted from the EEI filing requirement. Note that Schedule B/HTSUS numbers are not required to be listed on the ATA Carnet’s general list. However, all goods subject to licensing or other export controls must be reported, regardless of value.

This exemption needs to be recorded on the yellow exportation counterfoil in box 3 for “Other remarks” as: NO EEI per Exemption 30.37(a) |

|

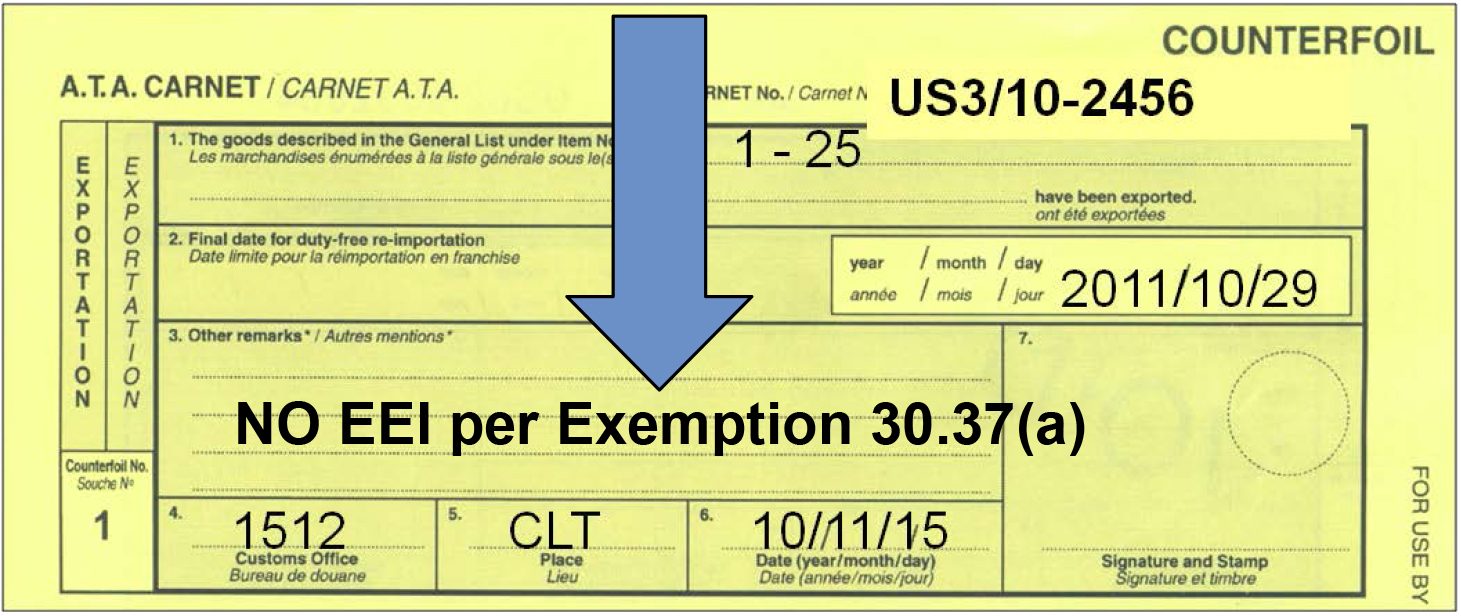

- Hand Carried Tools of the Trade: Goods that meet every one of the 6-prong test for “tools of the trade” (see 15 CFR 30.37(b)) will still be exempt from the EEI filing. Goods covered by a U.S. ATA Carnet that are not being shipped, but instead are being hand carried by the Holder or its sales representative or other authorized representative are not required to complete the EEI filing regardless of the intended use printed on the Green Cover. When hand carried or checked as excess baggage on a commercial airline, commercial samples, professional equipment and goods for exhibitions and fairs are all exempt from EEI filing.

The ATA Carnet and its goods must meet all of the following conditions to qualify for this exemption:

- Are owned by the individual U.S. Principle Party in Interest (USPPI) or exporting company, AND

- Accompany the individual USPPI, employee or representative of the exporting company, AND

- Are necessary and appropriate and intended for the personal and/or business use of the individual USPPI, employee or representative of the company or business, AND

- Are not for sale, AND

- Are returned to the U.S. within one year from the date of export, AND

- Are not shipped under a bill of lading or an air waybill (i.e., are hand carried or checked as baggage on a commercial airline)

This exemption only applies to U.S.-issued ATA Carnets. Foreign ATA Carnets that are being hand carried must still fulfill the EEI filing requirement if any Schedule B number’s total value exceeds $2,500. For items traveling with an export licenses certain restrictions still apply. (see 15 CFR 740.9).

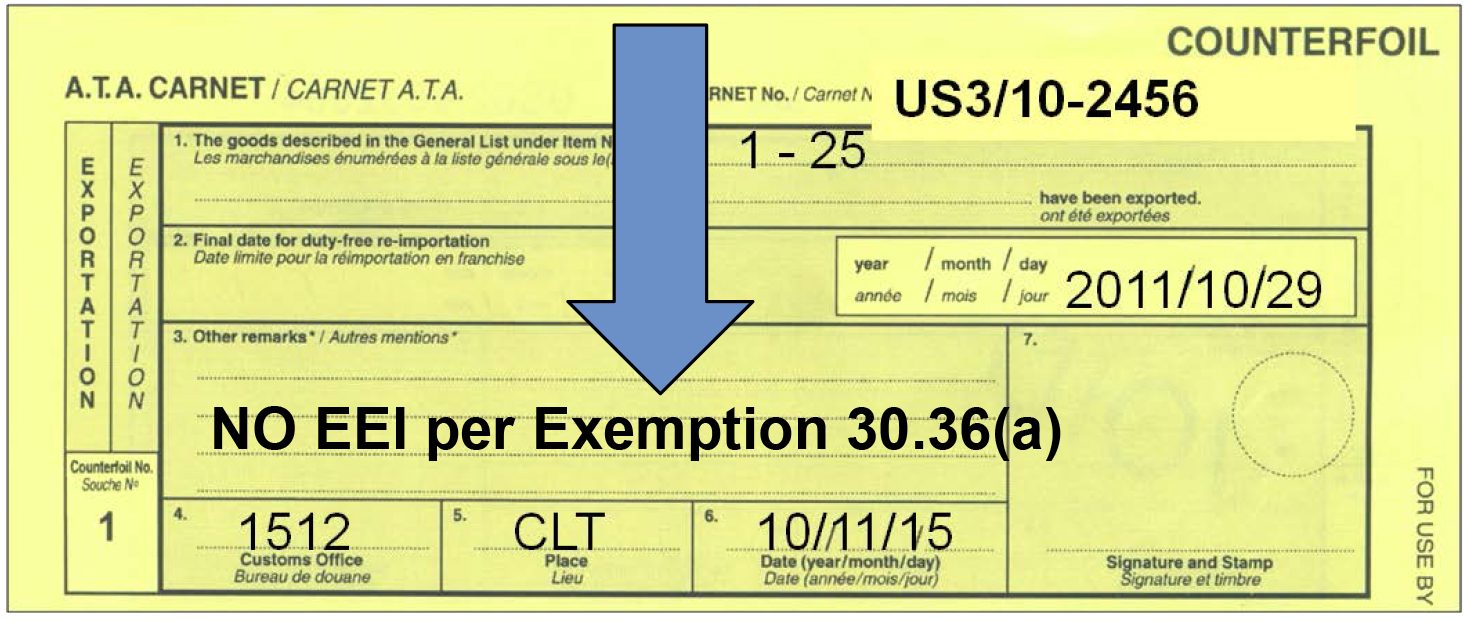

To benefit from the Hand Carried Tools of the Trade exemption, enter into box 3 for “Other remarks” the following: NO EEI per Exemption 30.37(b) |

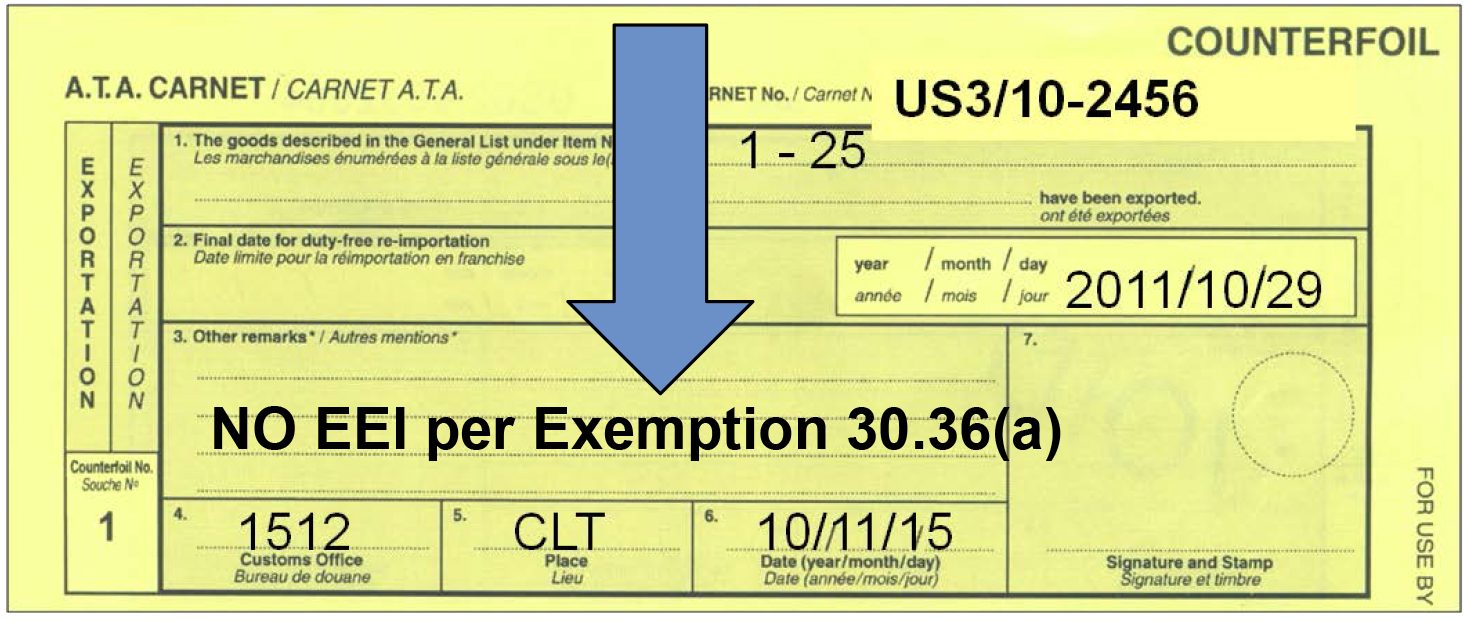

- Canada: shipments originating in the U.S. and where the country of ultimate destination is Canada, an EEI filing is NOT required is not required (see 15 CFR 30.36 (a)). This exemption does not apply to Foreign ATA Carnets. Any U.S. ATA Carnet traveling to Canada is exempt from the EEI filing requirement, as long as they return to the U.S. directly from Canada.

|

Export Licenses: new requirements for goods subject to export licenses on ATA Carnet

EEI filings will now require the value of the licensed good to be reported. This makes it easier to track the value of goods subject to licenses and accurately decrement exports from the licenses (see CFR 15 30.69(b)).

ATA Carnet Interpretation for EEI filing in AES

All ATA Carnet shipments that do not fall under the low valuation, or hand carry tools of the trade exemption, and are not destined for Canada must file EEI using the Automated Export System (AES). A filing must be executed for each exit out of the U.S., even if the ATA Carnet number and its goods (general list) are the same.

The following list will help you complete some data requirements in AES. These are not all the required and conditional fields, but rather those which require interpretation for ATA Carnet shipments.

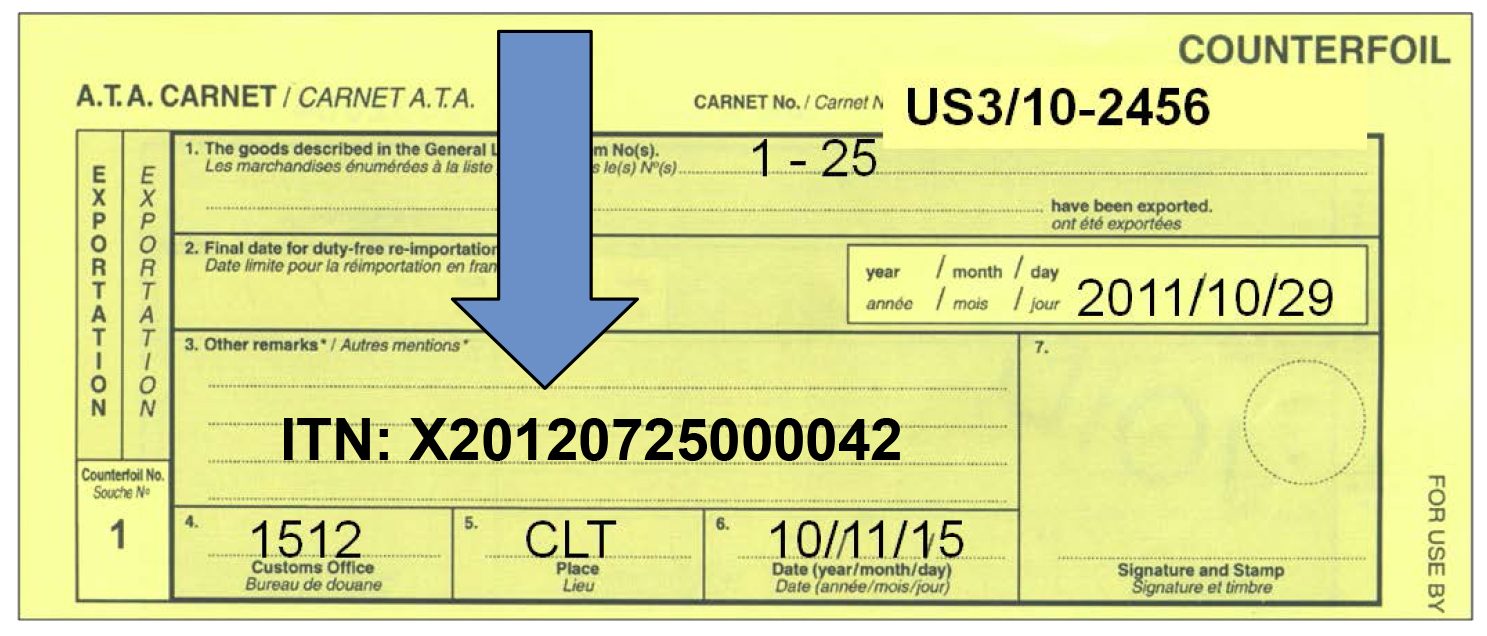

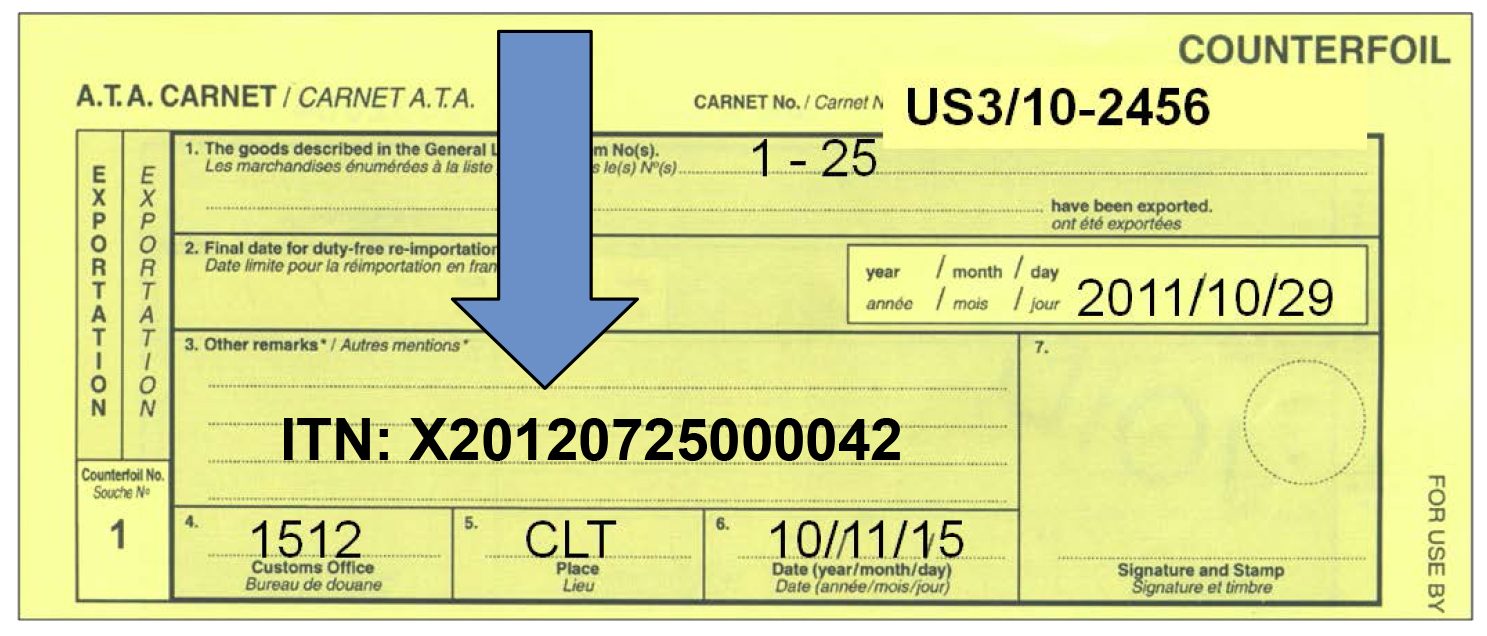

- E-mail Response Address: the completion of an EEI filing will generate an ITN (Internal Transaction Number). The ITN will be emailed to the address(es) provided.

- Origin State: where the goods begin their journey en route to the port of export.

- Port of Export: seaport or airport where the goods are loaded on the exporting carrier.

- Country of Destination: for a U.S. ATA Carnet this will be the first country the ATA Carnet and the goods are traveling to. In the case of a foreign ATA Carnet, the country of destination is the country where the ATA Carnet was issued, for example Germany.

- Departure Date: the date the goods will leave the U.S.

- Mode of Transport: the method by which the goods are exported from the U.S.

- USPPI: for the U.S. ATA Carnet this will be the company listed in box A (Holder) on the ATA Carnet’s green cover. For aforeign ATA Carnet this will also be the holder. Foreign holders may enter their passport number instead of an Employer Identification Number (EIN).

- Are the USPPI and Ultimate Consignee related companies?: yes, for both enter the Holder listed on the ATA Carnet.

- Cargo Origin: address of the USPPI where the merchandise actually began its journey to the port of export. For aforeign ATA Carnet, this will be the hotel, or local representative’s address or trade show venue in the U.S.

- Ultimate Consignee: for U.S. ATA Carnets use the Holder’s company name and contact, but the address will be the hotel or local representative’s address or the trade show venue in the foreign country. In the case of the foreign ATA Carnet this will be the holder company and its address.

- Schedule B or HTS number: required to be entered in AES for the EEI filing. Schedule B/HTS numbers do not need to appear on the list of goods (general list) on the ATA Carnet. Schedule B/HTS are only necessary for any commodity line whose value exceeds $2,500. U.S. Census has a tool to help you find the correct Schedule B number for your item:Schedule B Search Engine.

- Commodity Description: general description of the merchandise per Schedule B number. It is not necessary to be as detailed as the general list on the ATA Carnet. A basic description of the type of merchandise will suffice.

- Value: value of the goods at the U.S. port of export. This means the selling price or cost of goods sold if not sold plus inland or domestic freight, insurance and any other charges. 15 CFR 30.6(a)(16)

- Export Code: for all ATA Carnet shipments select CR.

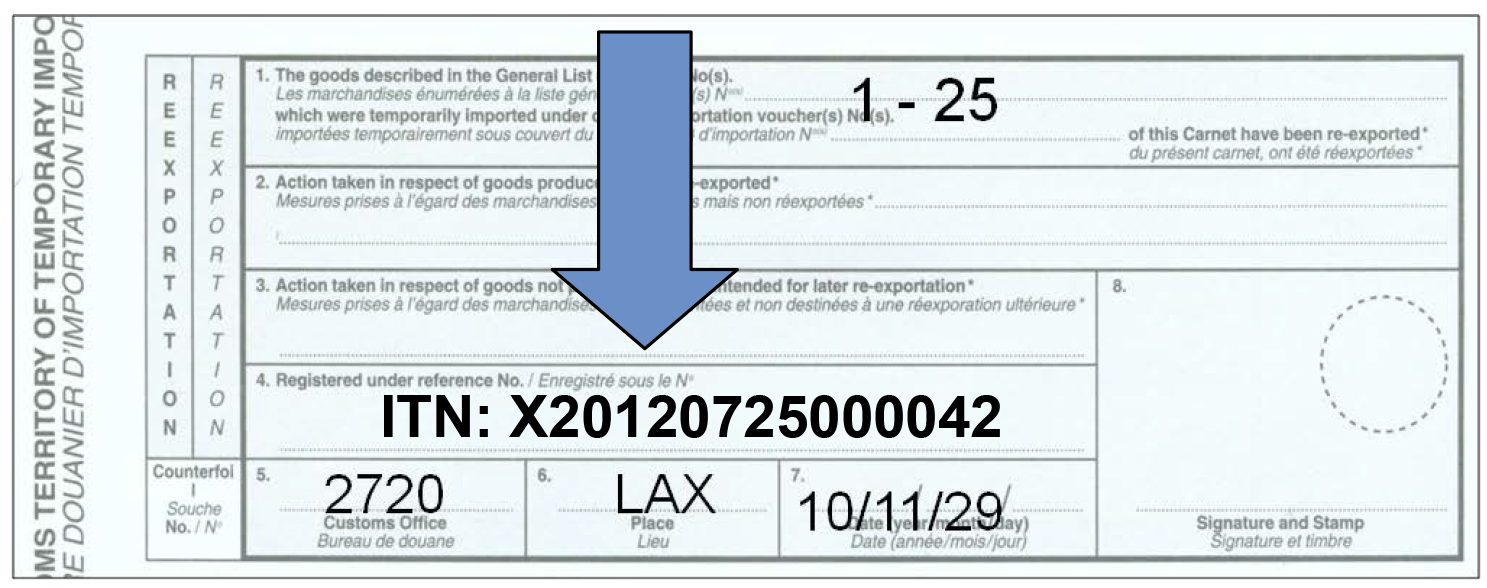

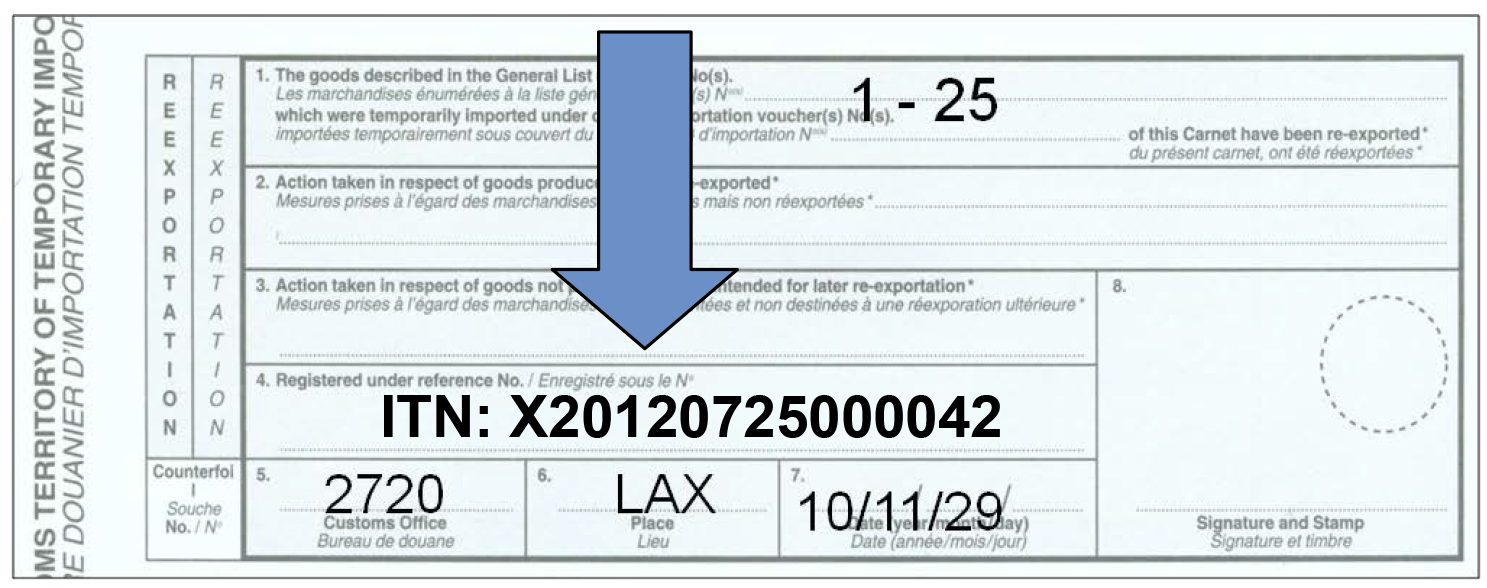

Once the EEI filing is submitted, you will receive an email confirmation containing your unique Internal Transaction Number (ITN). This must be recorded on the exportation counterfoil in the box 3 for “Other remarks” (U.S. ATA Carnet) or box 4 “Registered under reference No.” (foreign ATA Carnet). |

| U.S. ATA Carnet example

|

| Foreign ATA Carnet example

Penalties

Failure to file the EEI is sufficient grounds for U.S. CBP to potentially issue penalties against the exporter for violations of the Foreign Trade Regulations.

There are a number of changes to the Foreign Trade Regulations, especially how terms are defined and how information is to be reported. Roanoke strongly encourages all exporters to be familiar with laws and regulations governing the movement of goods.

The U.S. Census Bureau’s Foreign Trade Division’s website is an excellent resource for information. Census will also accept questions by phone (1.800.549.0595) or email regarding how the laws and regulations apply to your situation. |

This information is provided by Roanoke Trade, a division of Roanoke Insurance Group Inc. as a public service and for discussion of the subject in general. It is not to be construed as legal advice. Readers are urged to seek professional guidance from appropriate parties on all matters mentioned above. Insurance and surety risk management solutions for supply chains and transportation have been Roanoke Trade’s focus since 1935. Roanoke Trade is a subsidiary of Münchener Rückversicherungs-Gesellschaft (Munich Re) and an affiliate of Munich Re Syndicate, Ltd. Roanoke Trade closely follows the ever-changing government policies that affect the movement of goods, and works only with insurance companies financially rated as “A-” (Excellent) or better.

|