Claims Support

Business Insurance Claims

Claims Support

Before A Claim Occurs

You’ve heard that the best defense is a good offense. That’s true of insurance claims as well. Take advantage of your insurance company’s loss control offerings to reduce the potential for a claim.

Before a claim occurs, we recommend the following:

- Create a business-restoration plan to use in case of disaster. The plan should include names and contact numbers of suppliers, employees, and companies that clean, rebuild and do fire restoration work.

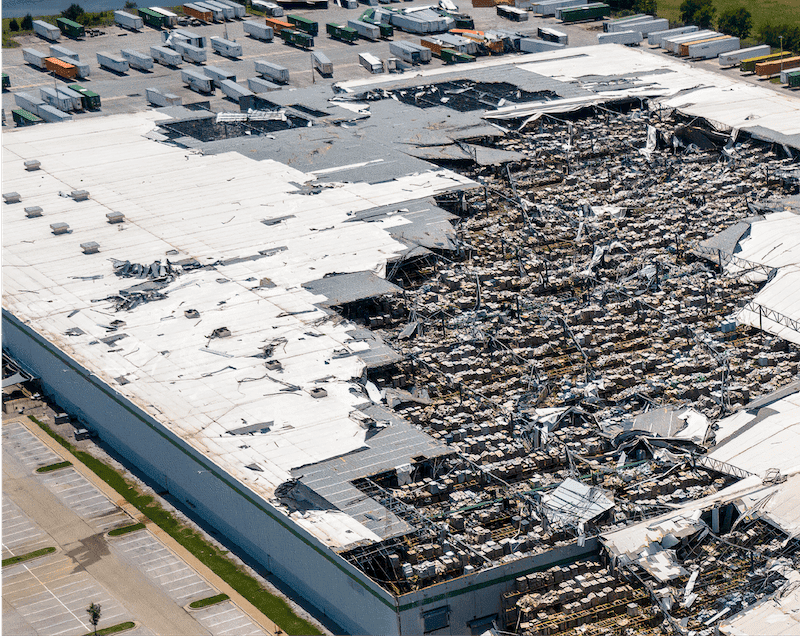

- The best defense in the protection of your real and personal property is an up-to-date appraisal or inventory with photographs to document the condition of the property prior to the disaster.

- Back up your systems daily. Arrange with your hardware and software vendors for replacement and/or temporary processing options.

- Store all of this information at another location.

Each type of insurance claim presents a different reporting structure. The information provided will assist you in gathering information and reporting a claim to your insurer.

All of your policies contain a clause that requires you report claims as soon as possible. Failure to do so can affect your coverage.

Claims Support

Property Claims

Depending on the nature of the loss, you may have already notified the police and/or fire department. Get the police report incident number if you can.

- Take steps to prevent undamaged property from being damaged. This may involve moving property to a more secure area.

- Prevent further damage. Contact a service company for clean-up of water, window board-up, repair of damaged locks, etc. Keep all receipts for any temporary or emergency repairs.

- Take photos of the damaged property.

- Contact Roanoke Claims at 1.800.ROANOKE or login to PolicyTrack to report your claim. Retain all damaged property (unless it presents a hazard).

If the event is widespread, the local media may provide instructions on filing a claim with a state or federal agency. Do so after filing with your insurance company.

Following a disaster, all insurance companies are swamped with claims. Bigger companies usually have sophisticated disaster response plans and may provide emergency offices in tractor-trailers. Smaller companies often have to depend on independent adjusters from outside the area. Usually an adjuster is available within the week, but depending on the size of the disaster, it could take several weeks.

Claims Support

Auto Accidents

Check the back of your insurance ID card. Many of these have instructions on handling and reporting a claim.

Do not admit liability even if you feel you were at fault. Let the police and your insurer decide.

- The police should be notified if the accident occurred on a public road. If damage occurred, and the other party chose not to contact the police, you should notify them anyway.

- Complete the motor vehicle report form you get from the police and send to the state (not to your insurance agent) to comply with Financial Responsibility Laws.

- Call your insurance broker or company at the number listed on your Auto ID card. Have the accident details and information about the other driver/car handy.

- Unless the vehicle can’t be driven, don’t leave it in a repair shop or assume you will be reimbursed for a rental car. Follow the insurance company’s instructions about inspection of the damage and where it can be repaired.

- In the event your vehicle is totally destroyed, provide the insurer with receipts for all recent maintenance and any custom upgrades installed on the vehicle. This may increase your claim amount.

- Let your insurance company handle the claim. If the other party is responsible for the accident, the insurer will pursue recovery on your behalf.

Claims Support

Commercial Liability

In any situation where someone is accusing you or your product of responsibility for an incident, do not accept or admit responsibility. Do not volunteer to pay for medical expenses or damages.

- Record information about the incident as thoroughly as you can, and advise the other party that you will report the claim to your insurance company.

- Investigate internally for further information about the incident. Identify any witnesses to the incident, and any documentation involving the occurrence.

- Report the incident to Roanoke Claims at 1.800.ROANOKE or through Policy Track.

- Promptly forward Summons and Complaints or attorney’s demand letters to your broker.

Claims Support

Workers’ Compensation

Workers’ compensation claims should be reported to your insurer immediately. In your policy documents, you received instructions on how to file a claim. Generally, you are provided with a toll-free number to use for reporting.

The governing body for handling worker’s compensation claims is OSHA (Occupational Safety & Health Administration). OSHA sets standards for safe work environments, offers training and education, and maintains reporting requirements for these claims. Incidents involving serious injury (more than first aid) or time off from work must be recorded in a log which is available to OSHA inspectors should they visit your offices.

OSHA provides templates for reporting worker’s compensation incidents as well as the required log on their website at https://www.osha.gov/index.html

Like Commercial Liability, some level of investigation should be performed as to the circumstances of the claim.

- Investigate internally for further information about the incident. Identify any witnesses to the incident, and take a statement from them.

- Record information about where the employee was treated.

- Promptly forward hearing notices or attorney’s letters to your broker.